Or, Why You Should Care What Solar Leasing Companies Charge

Solar leasing companies have helped many consumers get solar on their roofs and reduce their electric bills without actually buying the solar energy systems and incurring those costs. Sounds good, right?

But of late, leasing companies like SolarCity are coming under fire. (Read this informative Forbes article for more.) Last year, two SolarCity subsidiaries filed a lawsuit against the federal government, claiming they hadn’t been paid $14 million in federal tax incentives, on top of the $244 million they had received. As a result of that action, federal investigators said they will go through the books of the two subsidiaries to see if they overvalued their sales contracts so they could claim more in tax incentives.

What is actually going on here, and why does it matter?

When a homeowner or business purchases a solar electric system, the federal government pays them back 30% of the system price in the form of a tax credit. This is one of the incentives that has made solar more affordable in recent years.

When a homeowner or business leases a solar electric system, the company that owns and installs the system, such as a SolarCity or a Vivint, gets the 30% federal tax credit.

Let’s go back to the homeowner or business who buys their solar because they know an outright purchase provides ten times the financial return of a lease or power purchase agreement in Massachusetts. (See page 9 of this DOER report and this recent blog article for back-up on that point.)

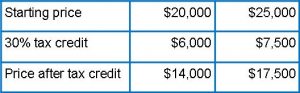

If the consumer pays $20,000 for a system, the 30% federal tax credit is $6,000, reducing the system price to $14,000. (I’m ignoring the MA state incentives that further reduce system cost, to keep this comparison simple.) If the consumer pays $25,000 for this same system from a different installer, the tax credit is greater at $7,500 but the net price to the consumer is also higher at $17,500.

Clearly, the homeowner is better off with the $20,000 system, all other things being equal.

But, what if you’re a leasing company that is going to own the system? Do you care more about the final price (you are most likely heavily financed by investors), or more about getting the maximum tax credit back from the federal government, which is essentially “free money”? If you care more about maximizing the tax credit, a higher system price is to your benefit.

Am I saying that leasing companies are inflating their prices to get more back in tax credits? No. But it’s interesting that the Massachusetts Dept. of Energy Resources’ list of solar installations from 2013 says that Vivint’s average price-per-watt in 2013 was $6.98, the second highest in the state.

New England Clean Energy’s average price-per-watt last year was $5.07. That is far from the cheapest in the state, but we sell lots of premium SunPower panels with our systems, which drives up our price-per-watt compared to companies only offering standard panels, like SolarCity and Vivint.

When a leasing company inflates its prices, who benefits? They do, through greater tax incentives. Who pays for it? The taxpayers whose income taxes fund the federal renewable energy tax credit.

I’m not accusing these companies of doing anything wrong. These companies are big. They have big investors who demand high rates of return on their investments. They pay expensive lawyers and tax attorneys to check the laws, regulations and tax codes. But while inflating solar prices may not be fraud, is it morally and ethically wrong?

If you liked this article, you might also enjoy:

No comments yet. You should be kind and add one!

The comments are closed.