Taxes may be a dry topic, but if you want to save money with solar, this is a very important post. Please read on.

Taxes may be a dry topic, but if you want to save money with solar, this is a very important post. Please read on.

(See the glossary of tax terms at the bottom of this post if you’d like some key terms defined.)

Do I pay taxes?

People investigating solar regularly say to us, “I can’t take advantage of the 30% federal tax credit on solar because I don’t pay any taxes.” When we ask if they’re sure they don’t pay taxes, since the majority of Americans do, they say they always get a refund from the IRS at the end of the year.

If this sounds like you, I’d like to share a very important point: Even if you get a refund from the IRS at the end of the year, you probably paid taxes throughout the year through automatic deductions from your paychecks. The reason you get a refund check is because the IRS took more money from your paychecks than necessary. You get a refund because you paid too much in taxes during the course of the year.

But you are still paying taxes.

What are federal tax credits for solar?

The biggest incentive for installing solar on your property is the federal tax credit that pays you back 30% of your system price. Let’s say your system cost $33,345, a number I pick because 30% of that is almost exactly a nice, round $10,000. So if you bought that system, your tax credit would be $10,000. Here are some examples of what happens to that $10,000 in various situations.

In the first example, you’re getting a refund from the IRS because you paid too much in taxes. Let’s say the IRS withheld $19,000 in taxes from your paychecks, but you only owed $14,000 in taxes for the year. Normally, you would get a nice $5,000 refund check from the IRS. But, when you add in your $10,000 solar tax credit, your refund check becomes a big, fat $15,000 payment. Isn’t this fun?

| Taxes you paid via paycheck withholiding | $19,000 |

| Minus your total tax liability | $14,000 |

| Equals the amount of your refund check without solar | $5,000 |

| Plus your Solar Tax Credit amount | $10,000 |

| Equals the amount of your refund check with solar | $15,000 |

In this next example, I assume you owe taxes at the end of the year — $13,000 to be exact, because you should have paid $30,000 in taxes but only $17,000 was withheld from your paychecks. Normally, you would send the IRS that remaining $13,000, painful though that is. But, because you have a $10,000 tax credit, you only have to send the government $3,000.

| Your total tax liability | $30,000 |

| Minus taxes you paid via paycheck withholding | $17,000 |

| Equals the amount you owe the IRS without solar | $13,000 |

| Minus your Solar Tax Credit amount | $10,000 |

| Equals the amount you owe the IRS with solar | $3,000 |

OK, you’ve got my attention. How do I know how much I’m paying in taxes?

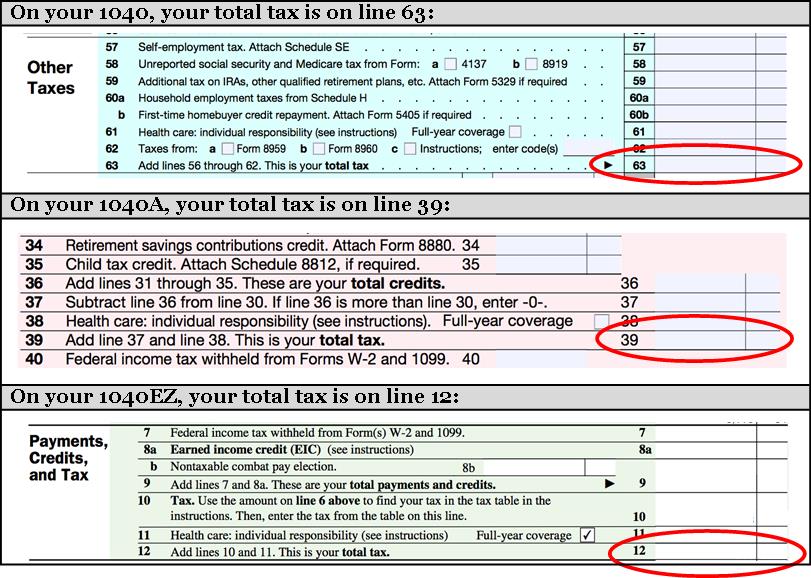

The easiest way is to look at your federal tax filing. Where to look depends on which form you filed. These images show you where to look on the three most typical tax forms.

Have a look at last year’s tax return to clarify what you paid in taxes. Then give us a call to see what size solar energy system you need, and we’ll estimate the tax credit you’ll get if you go solar.

Disclaimer: We are not tax advisors and do not pretend to offer tax-related counsel. Please consult your accountant to determine what impact the solar tax credit would have on your taxes, plus any other topics addressed in this post.

More Solar Tax Credits and Other Incentives

There are also additional credits, rebates and other incentives based on the state you reside in. Rhode Island Solar Installation Incentives, Massachusetts Solar Incentives, and New Hampshire’s 2017 Solar Incentives are ever changing so contact us for the latest solar incentives in your area.

Tax Terms

| Tax Terms | |

|---|---|

| Tax Liability | The amount of tax you are responsible for paying in a year. This is unlikely to match the amount that you either pay the IRS, or get from the IRS, when you file your tax return, since you probably paid some taxes in the course of the year. If you underpaid in the course of the year, you write the IRS a check. If you overpaid, you get a refund. |

| Tax Deduction | The taxes you pay are a percentage of your income. A tax deduction lowers your “taxable income” so you owe less in taxes. |

| Tax Credit | A tax credit reduces the actual taxes you pay, and is generally worth more to you than a tax deduction. If you owe the IRS money at the end of the year, the tax credit reduces what you pay them. If the IRS owes you a refund at the end of the year, you get a bigger refund with the tax credit added in. |

If you liked this article, you might also enjoy:

- Massachusetts Solar Prices as Good as Ever

- Solar in New Hampshire is Back

- Comparing Rhode Island Solar Incentives

Download our 7 FAQs

Download our 7 FAQs

7 Responses to “Can You Use the 30% Federal Tax Credit for Solar?”

I have a question about the federal tax credit. What happens if we have a tax credit coming to us of $10,000, but only pay a federal tax of $9,000? Will we be able to apply the remaining balance of the tax credit to our taxes the following year?

Yes, you should be able to apply the remainder of the tax credit the following year.

Although my 2015 income tax has not yet been filed, I expect it to be more than $4,000 but less than $5,000.

Wanting a system at about $33,345, can a $10,000 tax credit be used over the subsequent years, without loss?

Thanks,

Peter

We know personally of people who have spread the tax credit over 2 years, so that should be possible in your case. But we don’t happen to know of anyone who has spread it over 3 or more years – you should definitely check with a tax professional to see if that’s possible.

I have 0 zero tax on line 63. Does this mean I do not get a break on solar???

If you used Form 1040 and line 63 says your total tax is $0, then you will not get the 30% federal tax credit, because you have no taxes to offset. There are still other incentives such as the Renewable Energy Fund grant that reduce the price of going solar.

There is some confusion here, The solar tax credits are non refundable.That is a separate issue from your tax refund. What is important is your tax liability and that can be paid with the tax credit. I am in a situation that I have no (federal) tax liability. In order to use up the remaining tax credit I had to do a ROTH conversion of my IRA to create a tax liability that I could pay with the tax credit. The upside is my ROTH grows tax free and there is no taxes when I take it out.

The comments are closed.