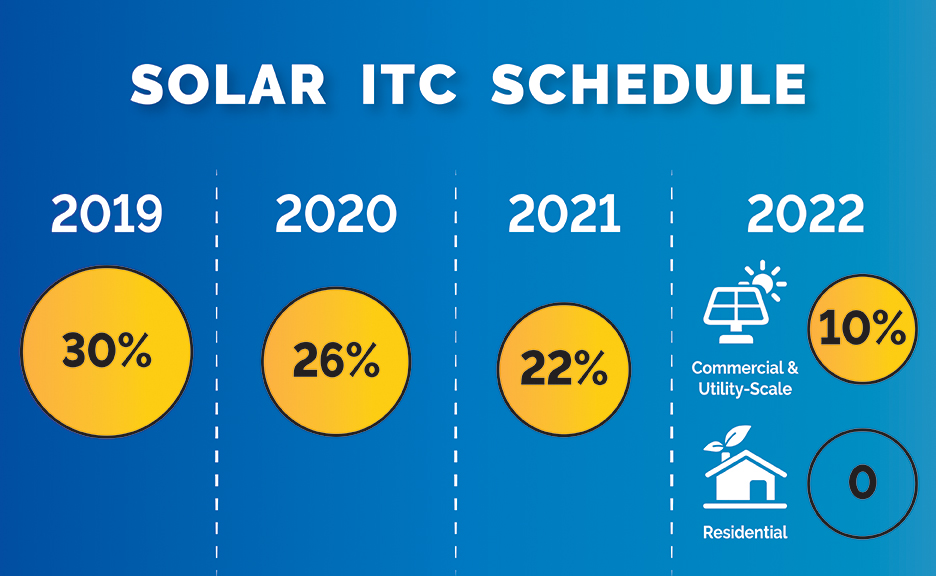

So went the famous line from the 1975 movie, “Monty Python and the Holy Grail” and now so does the Federal Investment Tax Credit (ITC) for solar systems. In short, the Federal Investment Tax Credit for going solar is not dead and gone. Instead, it has merely dropped a bit, whereby the old credit of 30% of your total cost is now a 26% credit. The system just has to be completed by the end of 2020. Not bad at all.

But the incentive to get a system now is large. As noted above, come this New Year you lose 4% in your Investment Tax Credit (roughly $1,400 to $1,600 for a typical system). And then at the end of 2020 the ITC rate is slated to drop to 22%, and then finally to zero at the end of 2021. That’s a pretty strong incentive.

That said, if you are looking at doing solar on a commercial building the rate does not drop to zero at the end of 2021, but it does drop to just 10%.

This table spells it all out:

Further, don’t lose sight of the fact that the solar tax credit is not the only incentive available. For example, the SMART program in Massachusetts steps down in blocks and we currently anticipate the current block will be used up as early as January 2020 in some areas. That jump is bigger for most than the reduced ITC. Or in Rhode Island their programs have thus far always shown a decrease from the previous one. So if incentives are important to you, it is important to not delay.

Limited 4% Discount Anyone?

To help ease the burden on the ITC change however, New England Clean Energy is announcing a 2020 Winter ITC Discount program. Specifically, for the first 30 customers that move ahead with their project in 2020 (but before March 15, 2020) we will discount their standard price by 4%. Given the time of year you might say “be kind to your neighbor, but be sure to sign before them”. It is our little way to extend the old 30% just a bit longer.

If you’re interested (or know someone who is), please contact us at sales@newenglandcleanenergy.com or 877-886-8867.

3 Responses to “Solar Investment Tax Credit: “Not Dead Yet!””

Thanks! This info and your discount are great to know about. I’ll spread the word!

Thank you!

Hey, Thanks for sharing such nice information with us, I glad to read it.

The comments are closed.