Big changes can often elicit confusion and worse, incorrect information. Our move to clean energy as a nation (and planet) is certainly no exception. In fact, it probably is a stellar example of the problem. But let’s focus on the myths surrounding the Solar Federal Investment Tax Credit (ITC), because where there is money concerned there is almost always incorrect information.

Let’s jump right in:

Myth: The Solar Federal Investment Tax Credit (ITC) is gone (untrue, it’s now 26%).

Myth: The Solar ITC does not apply to solar batteries (untrue, but there are requirements).

Myth: Without the Solar ITC solar can’t pay for itself (untrue, with a good roof you solar will pay you back).

So as myths, these three statements are untrue. But let’s dig a bit deeper.

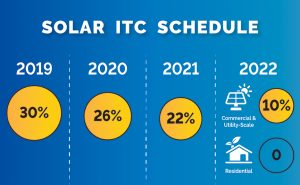

Our first myth is very simple and it starts with a tiny grain of truth. The “truth” part is that the solar ITC did go down at the end of 2019, but it did not go away. For several years before December 31, 2019 the Solar ITC was 30%, meaning that if you spent $30,000 to install solar on your house or business you’d get a $9,000 credit on your taxes. For most people that means the effective cost of such a new solar system would be just $21,000. Obviously, a pretty nice deal. But because an extension of that didn’t make into the budget deal signed at the end of 2019, the ITC stepped down effective January 1, 2020. The ITC rate is now 26%.

What’s that mean? It means the same $30,000 system installed in 2020 will cost – after the ITC – $22,200. Not quite as good I’ll admit, but if a store were having a 26% off sale would you turn your nose up at it? In short, there is still a lot of money to be saved.

The second myth is a tad more complex and it relates to an exciting new technology; solar batteries. Solar batteries are what most people believe will make solar a cornerstone of our green power future because with them you can shift the power your system produces during the day to the night (or even a string of less than sunny days). And further, they also make for a pretty nice nearly instant source of backup power that requires no fuel or mechanical maintenance.

But are solar batteries part of your solar system and hence part of the ITC in the eyes of the IRS? Or are they something different? The short answer is that the IRS has said yes, it is part of your solar system, but under one condition. That condition is that your solar batteries must be exclusively charged by the sun.

So what does that mean in dollars? Well, battery costs vary a lot based on their size (and thus the amount of power you can store), but generally you’ll see an average of perhaps as low as $10,000 to a more typical range of $15,000 to $20,000 (although just as with solar, the sky can be the limit). So that means if you buy a system at say $15,000 it will only cost you $11,100 after the ITC. Not a bad deal for backup power that will never need gas, propane, or any mechanical maintenance.

And the third myth? That solar is only worthwhile if you get the ITC? Well, again that’s just not true and the math will prove it. It just takes accepting one simple fact. Once your solar system is set up you are generally done paying for it. It will produce power reliably for years and years to come. The panels are warrantied for 25 years in most cases, but they will almost certainly last longer. And any maintenance costs are going to be negligible because there are no moving parts. Conversely, if you built say a coal or gas fired power plant you’ll have to keep feeding it. Plus, it is mechanical so it will need a lot more maintenance. In short, the math just works for solar.

But my advice would be to not test my assertion on this last myth and make sure you get the ITC credit!

Install solar this year and enjoy a 26% ITC. Or, if you just have to wait it will go down to 22% in 2021. Still not bad. In short, unless there is new legislation extending the ITC you’ll have to wait until 2022 to make sure you don’t get a Federal Investment Tax Credit. So, as I said, don’t wait.

Because solar is the power that will drive our collective futures.

If you liked this article, you might also enjoy:

Download our 7 FAQs

Download our 7 FAQs

2 Responses to “Is the Solar Federal Investment Tax Credit Gone? NO!”

You were here a while ago.

Still Thinking about solar on my roof perhaps this Spring with a battery..

Let me know what would be involved…

Carl Canner XXX XXX XXXX

The fact that a country encourages the use of clean energy through tax subsidies, demonstrates how much it excels for the quality of life of its population. I hope this awareness will spread to our country and the world. Congratulations on the post for keeping us informed.

The comments are closed.