Data source: [1]

As opposed to solar panel installations, Fossil-fueled electricity is at the highest price per million British thermal units (MBTU) since February 2014, says CNN Business. [2] And that price is not decreasing. National Grid [3] and Eversource Energy [4] recently filed for approval to raise their electricity rates. Though the changes are pending, this shows how the electric companies seek to charge more money for the same electricity.

Why would they increase their prices, though? The answer is in natural gas.

The COVID-19 pandemic cut natural gas demand. As people lost jobs or moved to remote work, the need for office lighting, air conditioning, heat, etc. fell. In 2020, this was not a crisis for consumers. The natural gas supply outpaced demand. This drove prices down. It also made natural gas easier to find on the market.

Yet for natural gas companies, it represented a problem.

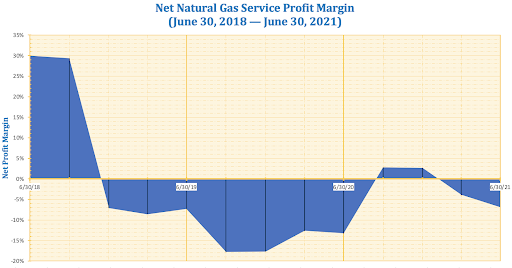

Net profit margins are the portion of revenue left after covering all production costs. For natural gas services, they are often slim. This assumes that profits are even made at all. Since 2019, natural gas services often generate less revenue than they cost (see chart below). This makes natural gas sensitive to the effects of demand (and by extension, prices) dropping significantly. To offset the decreased value, investments in natural gas extractions and storage fell. After all, mining for gas is pointless when the market is oversupplied. This strategy saw success in the short term. By the end of 2020, the natural gas companies balanced supply and demand to eke out a small profit.

Data source: [10]

Enter 2021.

2021 saw fewer pandemic constraints for most of the world. People begin to find jobs and work in-person again. With that, the natural gas companies had the opposite problem to the one they had in 2020. The demand for natural gas outpaced the companies’ ability to supply it. Worse, supply chain issues plagued natural gas. Meeting fuel demands now calls for more than taking gas out of the ground.

But wait, you say, this sounds like pandemic fallout.

Surely, this is all temporary, right? Unfortunately, no. The outlook is not cheap for natural gas.

Predictably, natural gas companies expect difficult years ahead. Because they are not a monopoly, in the US, they can set their prices as they please. This lets them quickly get ahead of future difficulties. Electric companies, however, are a monopoly. So they must file paperwork to get price changes approved by the state government. They too want to get ahead of market shifts that impact electricity costs. This drives them to submit higher price hikes to the state. After all, if they undershoot the trajectory of energy costs, their profits take damage. Electric companies also have to submit pricing decisions to bureaucracy for approval. This means that even in ideal times, it can take months to fix mistakes. So electric companies have an interest in inflating energy costs.

All in all, natural gas’s market value surges. With that, electricity prices loosely follow.

Alternatives to fossil fuels like solar panel installations are unaffected by natural gas’s markets. They can greatly reduce your electric bills— just ask some of our satisfied customers [4-9] who went solar. New England Clean Energy has been doing solar panel installations and helping customers in New England with their solar needs since 2006. If you live in Eastern Massachusetts, New Hampshire, or Rhode Island, we are happy to help you go solar on your terms. Schedule a consultation today, or use our ballpark estimator tool to see what solar savings might be waiting for you.

Works Cited

[1] Barchart Solutions [2021] Custom Commodity Prices Search: Commodity Type: Natural Gas, Rigzone. Available at: https://www.rigzone.com/news/commodity/customsearch/ [Accessed 5 Nov. 2021].

[2] Egan, M. [2021] Home heating sticker shock: The cost of natural gas is up 180%, CNN. Available at: https://www.cnn.com/2021/09/28/business/natural-gas-inflation/index.html [Accessed 5 Nov. 2021]

[3] Massachusetts Electric Company and Nantucket Electric Company d/b/a National Grid Basic Service Filing [2021] 21-BSF-D3 (MA DPU) Available at: https://eeaonline.eea.state.ma.us/DPU/Fileroom/dockets/bynumber/21-BSF-D3 [Accessed 5 Nov. 2021].

[4] New England Clean Energy [2020a] Great Solar Installer Makes Happy Customers. Available at: https://newenglandcleanenergy.com/solar-panels/residential-customer-stories/great-solar-installer-makes-happy-customers/ [Accessed 5 Nov. 2021].

[5] New England Clean Energy [2020b] Making Solar Affordable. Available at: https://newenglandcleanenergy.com/solar-panels/residential-customer-stories/making-foxboro-solar-affordable/ [Accessed 5 Nov. 2021].

[6] New England Clean Energy [2021a] Residential Solar Testimonials. Available at: https://newenglandcleanenergy.com/solar-panels/residential-testimonials/ [Accessed 5 Nov. 2021].

[7] New England Clean Energy [2021b] Solar Success: Splendid Surprises and Significant Savings. Available at: https://newenglandcleanenergy.com/solar-panels/residential-customer-stories/solar-success-splendid-surprises-and-significant-savings/ [Accessed 5 Nov. 2021].

[8] New England Clean Energy [2021c] Who Doesn’t Like Getting Two for the Price of One? Available at: https://newenglandcleanenergy.com/solar-panels/residential-customer-stories/why-is-solar-good/ [Accessed 5 Nov. 2021].

[9] NSTAR Electric Company d/b/a Eversource Energy 2022 Performance Based Ratemaking Adjustment [2021] 21-106 (MA DPU) Available at: https://eeaonline.eea.state.ma.us/DPU/Fileroom/dockets/bynumber/21-106 [Accessed 5 Nov. 2021].

[10] Zacks Investment Research, Inc. [2021, Jun. 30]. Natural Gas Services Profit Margin 2006-2021 | NGS. Macrotrends. Available at: https://www.macrotrends.net/stocks/charts/NGS/natural-gas-services/profit-margins [Accessed 5 Nov. 2021].

Download our 7 FAQs

Download our 7 FAQs

No comments yet. You should be kind and add one!

The comments are closed.