If you are considering clean energy or recently had solar panels installed, you should understand how simple it is to receive your federal tax credit. Don’t let the word “tax” scare you away; it is much easier than you think.

Who’s eligible for the solar tax credit?

The first thing you should know is whether or not you are eligible. First and foremost, you need to be a resident of the United States and have a taxable income. Next, you need to have solar panels installed in your primary or secondary home. In addition to solar panels, battery storage systems also count towards the tax credit.

How to get your solar tax credit?

Once you have established your eligibility for the federal tax credit, to actually claim your credit is very simple. All you have to do is fill out the proper forms. You can request the first form called the IRS Form 5695 from the IRS. This is a two-page form that has you fill in your costs, kilowatt capacity, and home address information. After this form is completed, you add the renewable tax credit information to your Schedule 3 and Form 1040. The process is the same for everyone and takes one extra step from your normal taxing process.

What expenses are included in the solar tax credit?

Many things are included in the tax credit. First are the cost of your solar panels. Next, any of the equipment that is needed for mounting is included in the taxing. Lastly, any costs needed for installation preparation, the actual installation, and inspection are included.

What if you pay very little in taxes?

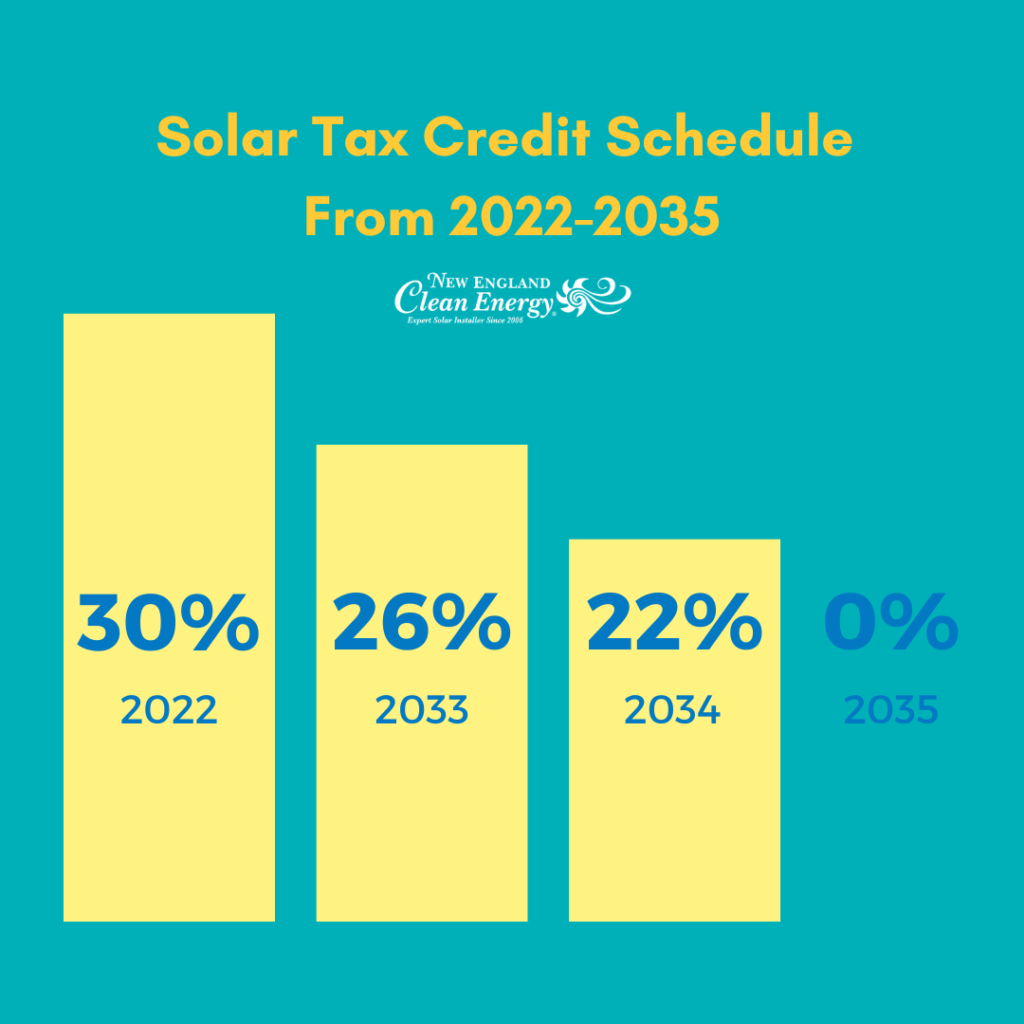

You must be paying enough to the federal government in order for the credit to offset your tax payment. The tax credit is 30% of the installation. To put this into perspective, if your panel installation was $12,000, you would receive a tax credit of $3,600. You can roll over any remaining tax credits until the next year. For example, if you are eligible for $6,000 in solar tax credits but only owe $3,600 in taxes one year, you can use the $3,600 towards your taxes and the remaining $2,400 credit will roll over to the next year. That $2,400 credit can then be applied to the next year’s taxes. Do not be worried about losing your tax credit, the 30% tax credit can roll over for up to ten years.

Final Thoughts

For anyone considering solar panels but is confused or worried about how to receive your tax credit, do not be scared away! Determine your eligibility, understand your benefits, and fill out your forms and you are all set. Overall, the process is simple and takes much less time than you would think and the benefits are worth it!

If you liked this article, you may also like:

How Many Solar Panels Do I Need?

5 Benefits of the Inflation Reduction Act for Solar

How Your Home With Solar Panels Can Charge Your EV

2 Responses to “How Does the Solar Tax Credit Work?”

I installed my panels this past summer of 2022. So far in three months I have not had an electric bill. My last bill I received was $-3.16 that’s correct $-3.16 compared to my normal 400. to 500. per month electric bill.

This was a no brainer and I’m very pleased that I did it. New England Energy were very helpful in the process and explained and answered any questions. They even set me up with a finance company who with very little effort lent me the funds to make this all possible.

A very happy and satisfied customer.

Moses Maciel

Thank you so much for leaving this kind comment! We would love it if you took this comment and left a review on Google or EnergySage!

The comments are closed.