As they say, you can’t predict the future, but at the moment it would be hard to blame anyone that was feeling maximum “Fear Of Missing Out” (FOMO) when it comes to going solar.

Yes, technology will keep marching on and prices will continue their decline, but there is definitely less room for significant price drops given how far down we’ve already come. But solar incentives including the federal tax credit for solar panels are also on the decline, and that is a direction I suspect a lot of people will not like.

In short, it’s looking more and more like now is the time to get off of the solar sidelines and jump into the game.

So given that we thought it would make sense to try clearing the fog a bit and do a roundup of the various incentives available in our region so you, our readers, can have a better handle on what’s available now – and what may be soon going away. Hopefully it’ll help you – or a friend still considering solar – to plan accordingly.

The Shrinking Federal Tax Credit for Solar Panels (ITC)

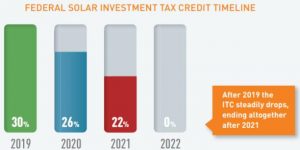

If you haven’t heard about the shrinking ITC yet, you will soon. That’s because the 30% federal tax credit for solar panels is set to start a steep downward trend, beginning at the end of this year (barring any new federal legislation).

For those unfamiliar with the ITC, it is a simple 30% Federal tax credit that reduces the taxes you’ll pay (after all your usual deductions etc.). So if your system costs $30,000 you can reduce what you pay in taxes by $9,000 (or 30% of $30,000). And if you can’t use it all the first year, then you can just roll any unused credit over to the next year. For many people, it feels like free money (well, because it pretty much is!).

What’s happening, as you can see in the chart above, is that the 30% ITC will become 26% next year. And if you miss 2020 it’ll drop to 22%. And then if you miss that, it’ll go to 0% (except for commercial customers who will bottom out at 10%).

Net, there is an approximate 13% difference in cash back to you between going solar this year versus next and then still bigger steps the two years following. No matter how you look at it, that’s a lot of money to leave on the table.

Talk about your FOMO moment, right?

Massachusetts “SMARTs” in Decline!? But Municipal’s May Brighten

Much like the ITC, the Massachusetts SMART program that replaced the popular SREC and SREC II programs is also built to decline in value over time. But unlike the ITC, the decline is based on a first come first served basis – not a fixed date.

SMART pays you for the total production of your solar array over the course of 10 years. Each month you’ll get a check from your utility for the production of the system. Each unit of electricity you produce will earn you a set amount of SMART income. It doesn’t matter whether you use the electricity produced in the home or send it all back to the grid, you’ll get the same amount of SMART income.

The catch is that the program has a tiered/blocked structure and each block has a declining value. When you sign up initially you get locked into the program at the current block. You are then guaranteed that fixed SMART rate for the full 10 years of the program. So the sooner you sign up, the higher the SMART value you get.

Although the program is relatively new, it is in block 2 for both Eversource and National Grid customers (systems under 25 kW). This means each block will take roughly 3-4 months to fill up. But there’s a huge rush at the end and the last 10-15% of the block typically fills in a week. Once the block is full, any new signups will be in the subsequent block at a lower value.

To get locked into the SMART block, we need a signed agreement with us as your installer, a full copy of your electric bill, and a SMART disclosure form that we fill out. If you’re thinking about doing solar any time in the near future, you’re better off getting into the earliest block so that you can get the most amount of SMART income.

And one exciting development is a brand new Municipal utility program that’s an offshoot of the SMART program. Starting June 1st, this program brings towns like Concord, Stow/Hudson, and Shrewsbury into a SMART like program with a generous $1.20 per watt rebate. However, funds are limited and the program will end no later than June 30, 2020 (if any funds last that long). We recently sent out a special edition newsletter to folks we believe are in a municipal serviced town, but if you want more details you can see that newsletter here.

Rhode Island Keeps Plugging Along – But at Lower Rates

In Rhode Island, the REF and REG programs also keep coming back, but if you have followed them at all there seem to be two key issues to always keep in mind. First, each program’s “open period” has a fixed size and time period. Meaning, like with the Massachusetts SMART program you are competing with other solar buyers for a room in the program – as well as a deadline like the ITC. But in truth, the amount of available funds is the real driver. For example, this past January we saw one program open at 9 AM and close by noon. That is why, as we’ve said previously, it is time now to get ready for the next go round.

Further, while the programs do keep coming back, they have always come back with lower incentives. Again, meaning that the “earlier adopters” get more out of the incentives than those that jump in later.

We know that getting in early isn’t for everyone and I don’t want to be accused of over-reaching on the urgency issue here, but conversely it would also be remiss not to point that at least I believe there is a significant value at the moment for not delaying any longer.

In New Hampshire System Size is Nearly No Object

And in New Hampshire, while there are no state incentives at the moment, don’t lose track of the fact that there is no net metering cap all the way up to 100 kW. I can tell you right now an awful lot of our customers in Massachusetts and Rhode Island customers would like that opportunity. Because in those two states you are generally very limited. Yes, they can go bigger but they may miss out on the significant value of full-value retail net metering.

In fact, net metering is so important to the financial picture for solar that we plan to publish a new blog in the near future on all the details behind it and why we believe it is a critical component for any state to get to 100% green energy.

No comments yet. You should be kind and add one!

The comments are closed.